Responsible Investment Policy FAQs

1. Why did UVic update its Responsible Investment Policy?

UVic believes climate change is a key global issue of our time.

The university is deeply committed to sustainability, and the urgent need to address climate change across society and in every university domain (research, education, community engagement and campus operations). Our goal is to be a global leader in environmental and societal sustainability, including responding to the critical global issue of climate change.

Our responsible investment policy for working capital investments is one more way the university can address climate change and support sustainable futures.

2. How was the responsible investment policy developed?

The administration worked for several months on policy options for the Board of Governors that are consistent with the goals in our Strategic Framework, of which Sustainable Futures is one of six strategies, and our fiduciary responsibility to steward these funds.

This work involved extensive research, including submissions from:

- student groups;

- research analysis;

- consultation with the students;

- consultation with faculty members;

- consulatation with other campus members and stakeholders; and,

- education sessions with external experts for the board members in September and November.

3. What is the policy’s main elements?

- Materially lower the carbon emissions across the entire portfolio by 45% by 2030;

- Invest 25% of the portfolio in thematic impact investments that promotes sustainable futures or supports Indigenous economic development;

- Participate in engagement activities to encourage carbon emission reductions; and

- Using tools including collective engagement and becoming a signatory to the PRI to encourage better disclosure of carbon emissions and climate related risks.

4. How did you set the target of a 45% reduction by 2030?

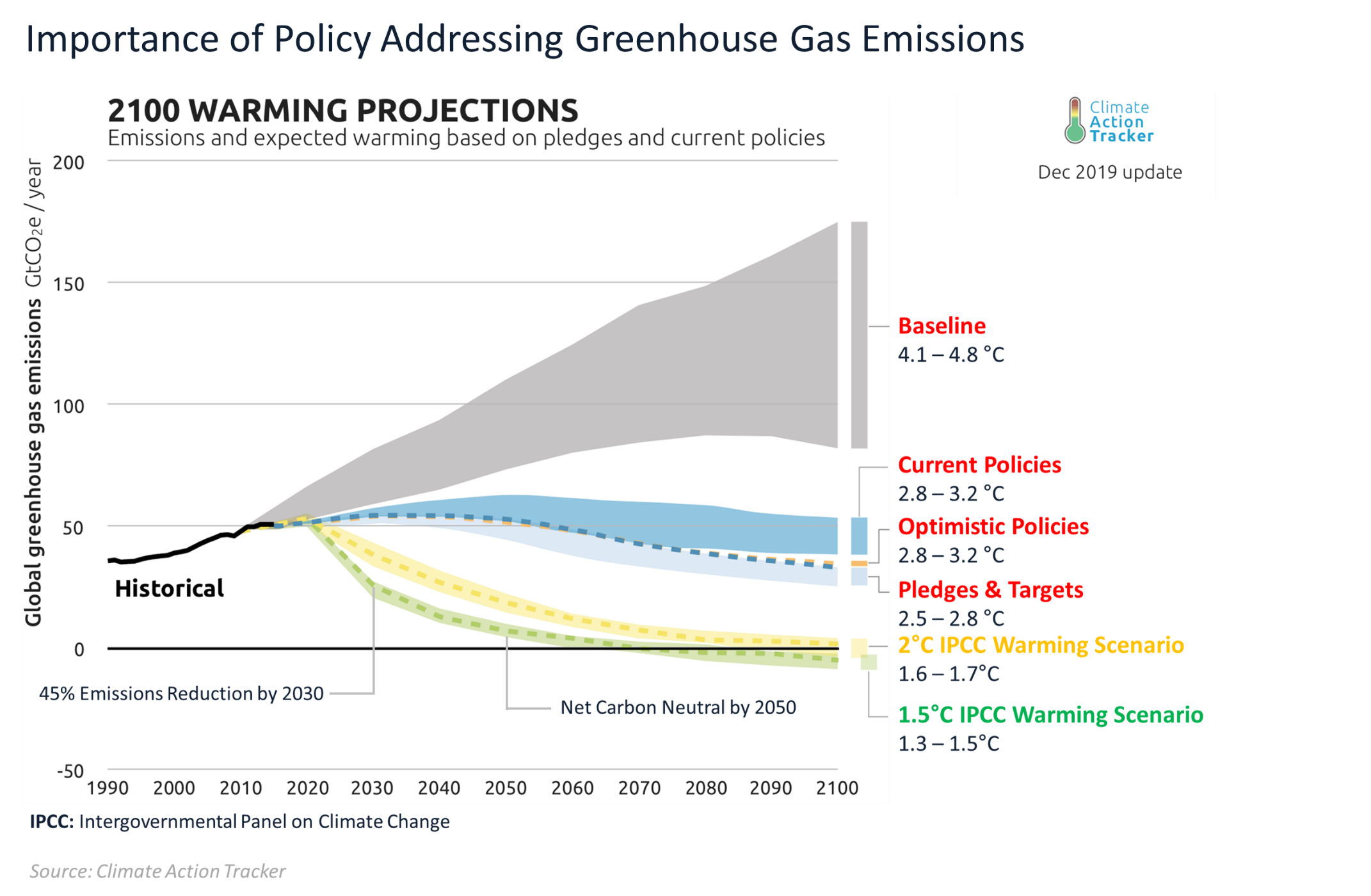

The university’s decarbonisation goal to reduce the weighted average carbon intensity of our working capital portfolio by 45% by 2030 was determined by referencing the Intergovernmental Panel on Climate Change’s urge to reduce CO2 emissions by 45% from 2010 levels in order to limit global warming below 1.5°C.

This is an ambitious goal that will challenge the university as this is a new and developing area and much of the data required is not available, however we believe it was an important goal to set.

Over the last year the Working Capital Investments reduced its weighted average carbon intensity by 32.6%. For more information please visit the Reports tab to access our latest Responsible Investment Report.

5. Will the policy result in divestment from fossil fuel companies?

The policy resulted in the university divesting from high-carbon emitting companies regardless of their industry sector, including from all investments involved in the extraction, processing and transportation of coal, oil or natural gas “fossil fuels”.

The policy provides a holistic and comprehensive approach to address climate change across our entire portfolio by encouraging carbon intensity reduction and investment in renewable energy and other clean technologies.

6. What is thematic impact investing?

The Global Impact Investing Network (GIIN) defines impact investments as investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Thematic impact investments are investments made in sectors where companies stand to benefit from macro-level societal or environmental trends.

The university’s policy not only reduces investments in high-carbon emitters, it allocates funds for thematic impact investments. Our thematic impact investments will align with the university’s Strategic Framework and further the UN Sustainable Development Goals.7. Why is Indigenous economic development included in thematic investments?

8. How does UVic’s policy compare with other universities?

The University of Victoria is among 15 Canadian universities in signing a climate charter to address the global crisis of climate change. Signatories to the charter pledge to:

- Adopt a responsible investing framework to guide investment decision-making, in line with recognized standards such as the UN-supported Principles of Responsible Investment (UN-PRI). Such a framework should:

- Incorporate ESG factors into investment management practices

- Encourage active engagement with companies to foster disclosure of ESG (including climate) related risks, and adoption of operational practices that reduce carbon emissions and foster ESG-positive behaviour more broadly

- Regularly measure the carbon intensity of our investment portfolios, and set meaningful targets for their reduction over time

- Evaluate progress towards these objectives on a regular basis, and share the results of such assessments publicly

- Ensure that the performance evaluation of our investment managers takes into account their success in achieving such objectives, alongside the other criteria for assessing their performance

9. How will UVic report on the goals outlined in the policy?

UVic will be releasing an annual responsible investment reports to provide information on UVic’s responsible investment approach and progress updates on the goals outlined in the policy.

Please visit the Reports tab on our website for the Working Capital Investments’ Responsible Investment Report.

10. How will this affect what the University of Victoria Foundation does with its investment policy?

The University of Victoria Foundation is a separate legal entity from the university with different fiduciary responsibilities, investment horizons and purpose. The Foundation’s investment policy has important distinctions from those of the university. There will always be differences in the investment strategy and tactical execution between the university’s investments that fund working capital and the Foundation’s investments that fund endowments.

To support its commitment to sustainability, the University of Victoria Foundation will be adopting a new Responsible Investment (RI) Policy before the end of 2021.