Endowment Distribution

The annual endowment budget received in the endowment spending funds (Fund 8XXXX) represents a summary of funds available for disbursement from the endowments invested by the University of Victoria Foundation. The endowment spending fund balance in FAST Finance Report also includes funds available from previous years (carry over).

In response to market conditions and the performance of endowment investments, the Foundation Board updated its endowment management policy in March 2025.

The following chart illustrates the change, which affects fiscal 2025/26 and future years:

| Endowment Fund Status (as at Dec 31 of prior year) | Fiscal 2024/25 distribution rate | Fiscal 2025/26 and future years distribution rate |

|---|---|---|

| MV less than 100% of IAP | 3.0% | 4.0% |

| MV between 100% and 108% of IAP | 4.0% | 4.5% |

| MV greater than 108% of IAP | 4.5% | 5.0% |

MV- Market value IAP- Inflation adjusted principal

Endowment FAQ

When do I receive an endowment annual distribution?

Each year in April or May, all departments receive an annual distribution in their 8XXXX endowment spending funds. The distribution is recorded in account 5528 (UVic Foundation Transfer).

Endowed Student awards and bursaries are managed by Student Affairs and Financial Assistance (SAFA) and Graduate Studies; they charge student awards to student’s tuition accounts or send payment to students.

Non-student award endowments are managed by the faculties/departments/centres that charge appropriate expenses to the respective 8XXXX fund assigned to each endowment.

Can I record non-endowment revenues in my 8XXXX funds?

No. The only revenue you can record in an 8XXXX fund is donation income (account 5510).

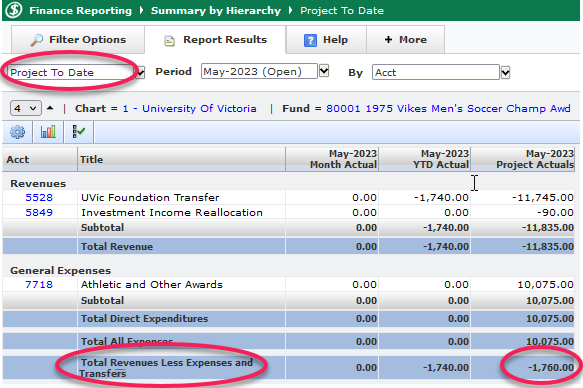

How do I know what my fund balance is?

Total Revenues Less Expenses and Transfers in Project to Date Report is the fund balance of 8XXXX fund. In this example, you have $1,760 surplus in this fund.

Where do I get a list of endowment spending funds?

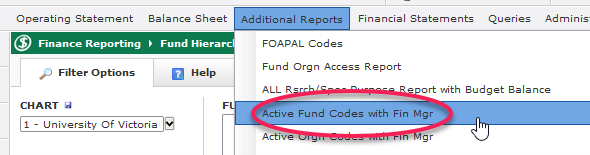

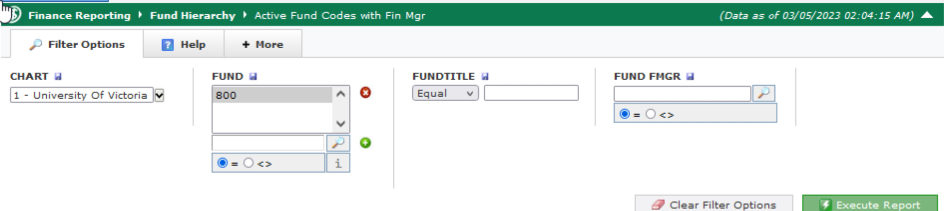

Please log into FAST Finance Reporting.

- Choose -> Additional Reports -> Active Fund Codes with Fin Mgr.

- Under Filter Options

- Select Chart 1- University of Victoria

- Enter “800” for Fund, and;

- Execute report

Can I record any expenses in my 8XXXX funds?

Only expenses that meet the terms of reference of your endowment fund are eligible to be recorded in 8XXXX funds.

Where do I get endowment terms?

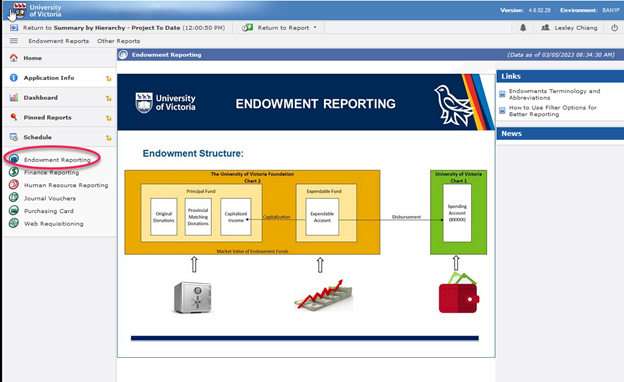

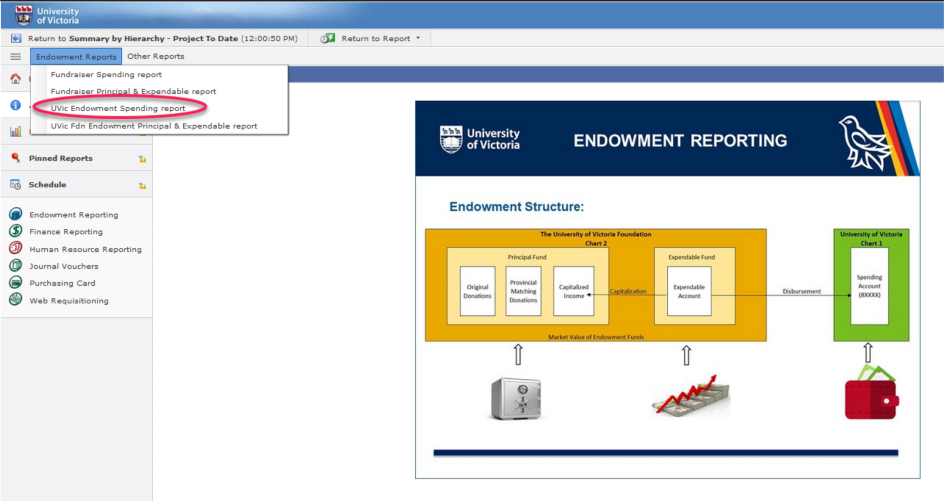

You can find terms of reference for your endowment funds in the Endowment Reporting Application.

What if I have expenses that meets the terms of an endowment in a non-endowed fund?

There are two options if you plan to make a transfer:

Option 1. Moving the expenses in the current fund to an endowment spending fund. The Sample journal entry is as follows:

Dr. 8XXXX-5XXXX-expense account

Cr. Current fund-orgn-expense account

Option 2. Prepare an internal charge entry to draw down from an endowment fund. The Sample journal entry is as follows:

Dr. 8XXXX-5XXXX-9203

Cr. Current fund-orgn-5909

How is an endowment budget distribution calculated?

The endowment base budget is 4% of the fund’s principal fund balance at December 31. An additional budget of 0.5% is granted making the spending rate 4.5% if the market value of the fund is greater than 100% but equal to or less than 108% of the fund’s principal balance. If the market value of the fund is greater than 108% of the fund’s principal balance, an additional 1% is granted making the spending rate 5%.

Any budget allocations above 4% should be considered as variable as funds can change categories annually based on investment performance. Note that the formula is adjusted for new funds that are established part way through the year.

How often is the distribution rate being reviewed?

The distribution rate is reviewed annually by the UVic Foundation Board with the intent to:

- protect the value of the fund against inflation over time so the donor is assured that the donation will continue to work for the benefit of UVic for generations to come, and

- provide stability in the earnings distribution to allow both recipients and UVic to plan ahead by knowing what funds will be made available each year.